The European Investment Bank (EIB) is a feature in the economic life of every region of Europe and, often, beyond. Interconnectedness has been at the heart of the EIB’s work throughout its history and it continues to be so today. Across Europe, the Bank’s investment draws the many countries of the European Union closer together. Our support for North Africa, the Middle East and Europe’s Eastern Neighbours creates growth and opportunity in these regions that, in turn, makes our own countries stronger.

Most of all, the Bank improves lives all over the world. At a time when the value of multilateralism is being undermined, the EIB’s work serves as a constant reminder of the power of integrated European efforts.

Our HQ: Founded in Brussels in 1958 as the Treaty of Rome comes into force, we moved to Luxembourg in 1968. We relocated to our current site in 1980 with a major new building extension completed in 2008.

Lending: From ECU 10bn in 1988, our annual lending neared €45bn in the mid-2000s before jumping to €79bn in 2009 as a temporary response to the crisis. It was €63.3bn in 2019.

Capital: From less than ECU 30bn in the early 1990s, our capital-base rose to €243bn on 1st February 2020.

Partner countries: We made our first agreements with non-Member States and non-European countries in the early 1960s. Now we work with over 135 non-EU states which receive around 10% of our funding.

European Investment Fund: The EIF was founded in 1994 to specialise in SME and venture capital investment. The EIB is the majority shareholder supported by the European Commission and private banks.

Our people: From a workforce of 66 in 1958, we passed 1 000 staff members in 1999, and the total is now over 3 450. Most work in Luxembourg, but we also have external offices, in the European Union and across the regions in which we are active around the world.

Europe and the rest of the world face the impact from successive crises during this decade. The European Investment Bank remains a cornerstone in facing the impact of the climate crisis, the COVID-19 pandemic and the unjustified invasion of Russia in Ukraine. The EIB launches its new logo, embodying its role as the EU bank.

The Investment Plan for Europe aims to make this a decade in which small and medium-sized businesses and innovative technologies find financial backing that might previously have been denied. A special capital increase allowed us to raise our support to the economic recovery and have considerable impact on the lives of citizens.

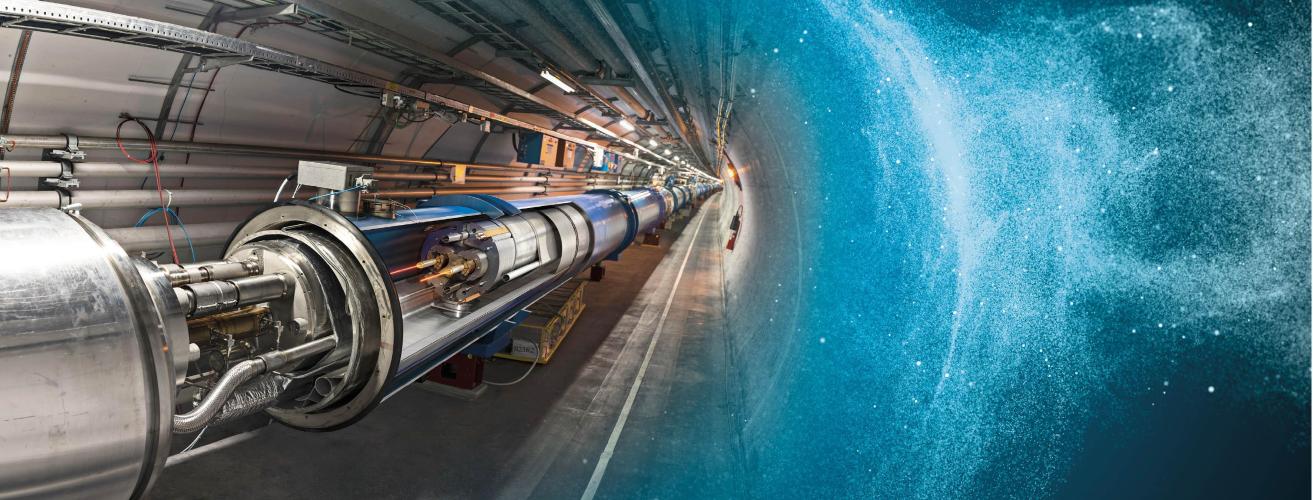

In 2007 the EIB issued the world’s first Green Bonds. Its mission? Raise more money to fight climate change, by financing projects in the field of renewable energy and energy efficiency. We also supported big science innovations, such as the final phase of construction of the large hadron collider at CERN, aimed at reproducing the conditions that existed at the beginning of the Big Bang.

Urban regeneration projects were a focus for EIB operations during these years, when the Bank started to provide financing to Eastern European countries after the fall of the Berlin wall. A decade of firsts: first operations in euros, first investments in Gaza/West Bank, first activities in South Africa.

Financing innovative European companies as well as strategic infrastructure that can connect the common European market has been a goal since EIB’s inception. During these years, the Bank moved to its new Luxembourg headquarters in Kirchberg, and issued its first operation in ecus.

In 1968 the European Investment Bank moved its headquarters from Brussels to Luxembourg. The first external offices were also inaugurated, starting with Brussels and Rome. The Bank focused mainly on financing strategic infrastructure, as well as on supporting the European industry in response to the energy crisis.

Amid the splendour of Michelangelo’s architectural innovations, six European countries signed the Treaty of Rome, which founded the European Investment Bank in 1958. Four years after its inception, the Bank was authorised to finance projects also outside the European Community. This marked the beginning of the extension of EIB’s activities around the globe.