Demand for loans increased and supply conditions eased in Central, Eastern and South-Eastern Europe—but improvements are primarily for households, rather than SMEs and big companies. Here’s what our CESEE banking survey shows

By Luca Gattini

The European Investment Bank runs a semi-annual bank lending survey for the Central, Eastern and South-Eastern Europe region to monitor, analyze and interpret banking and credit developments in the region. The survey investigates the strategies of international banks active in CESEE and the market conditions as assessed by the banks operating there.

International banking groups show supportive strategic orientations and market assessments

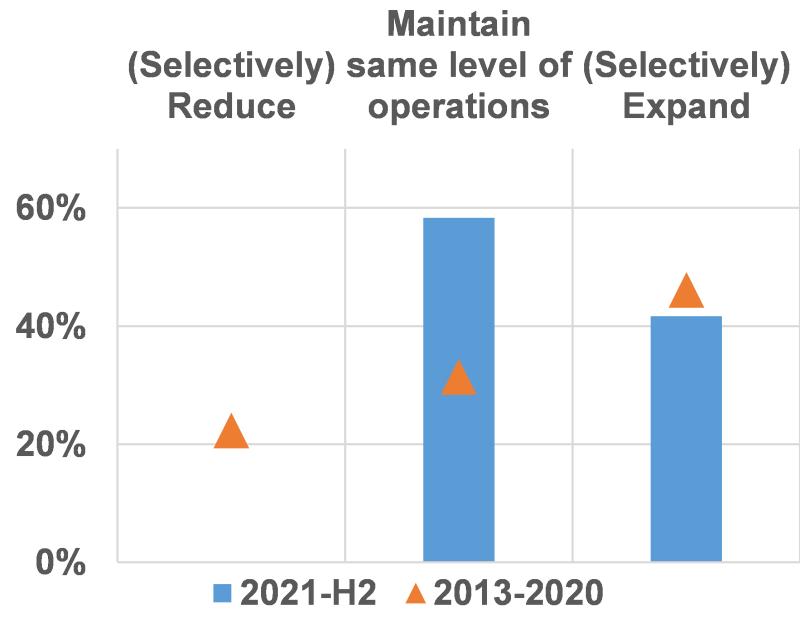

Cross-border banking groups signal positive strategic intentions towards their regional operations, pointing at full support for their subsidiaries and exposures during 2021. Around 60% of surveyed banking groups intend to maintain operations in the region (Figure 1), while 40% intend to somewhat expand operations.

The current stance remains an improvement from a couple of years ago, when an average of 20–30% of banking groups signaled intentions to either reduce or selectively reduce operations. It also suggests that many of the restructuring processes launched in the past have reached completion or are still on hold.

The profitability of regional operations fell somewhat last year during the first wave of the COVID-19 pandemic. Over the past six months, however, it is largely considered to have been equal to or higher than the profitability of overall group operations by more than 80% of banking groups, thus underpinning the positive strategic attitude to the region.

Figure 1. Group-level long-term strategies (beyond 12 months) in CESEE

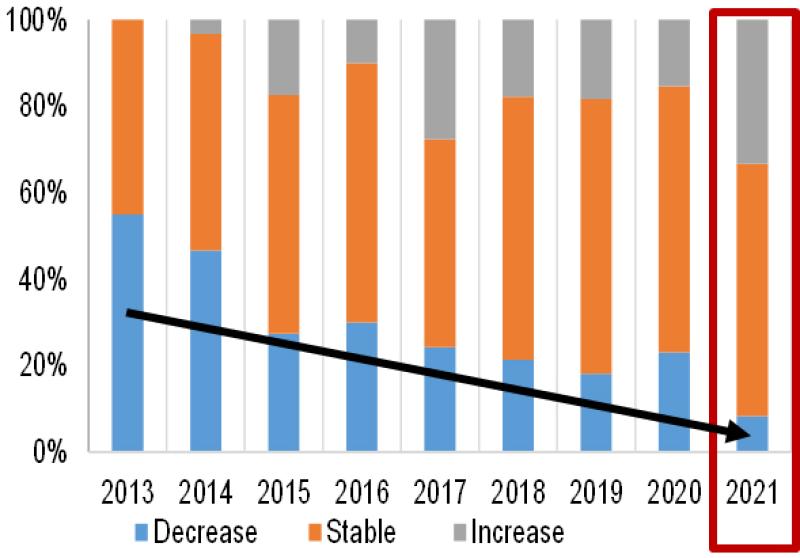

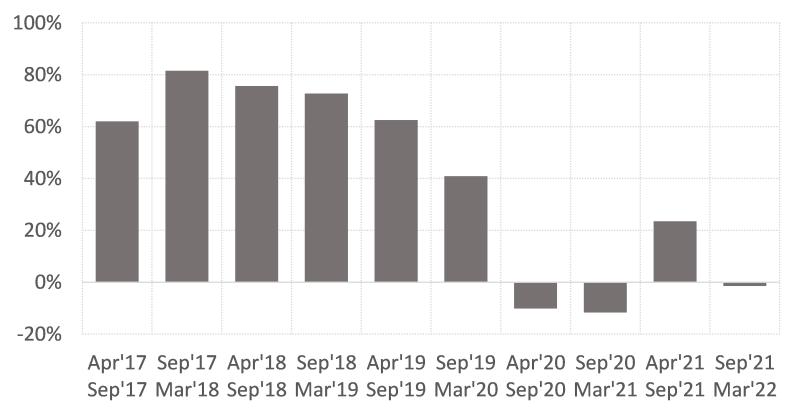

Balance sheet stability supports the region

Deleveraging at the group level (Figure 2) had already slowed significantly pre-pandemic (since 2017), when assessed against 2013 and 2014 levels. This trend persists in the latest survey. Specifically, the share of banks expecting to deleverage is at the lowest level since 2013, with many banking groups reporting a generalised stability stance or even an expected increase in their loan-to-deposit ratios compared to 2020. To corroborate this evidence, after the large negative COVID-19 shock in spring 2020, the trend in banking exposures to the region was positive over the past six months and expectations are for further expansions. This also signals that policy responses have been able to limit the most abrupt negative effects so far, thus avoiding unwarranted deleveraging.

Figure 2. Loan-to-deposit ratio (expectations over the next six months)

CESEE subsidiaries and local banks report an increase in demand for credit over the past six months

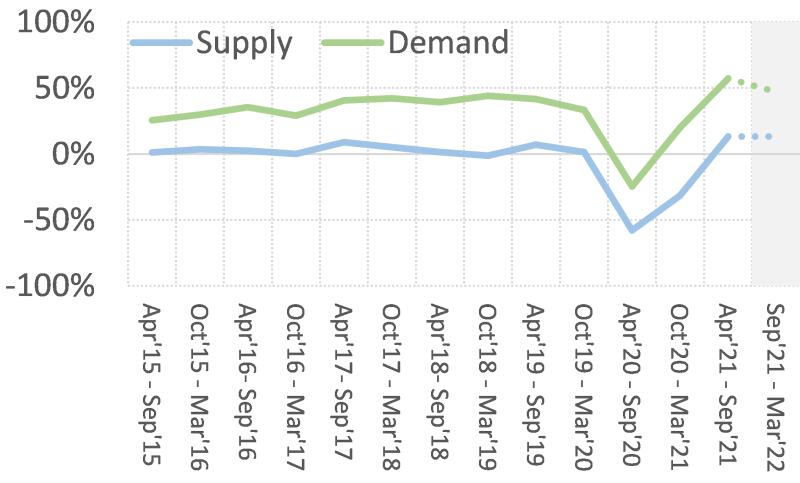

After contracting sharply in Q2 and Q3 2020, demand for loans and credit lines has continued to increase in the last six months (Figure 3) and accelerated further, compared to the initial part of 2021. This positive trend in demand is also aligned with expectations formulated in the spring 2021 survey.

The rise in demand was primarily supported by working capital, together with positive housing market prospects, consumer confidence and consumer expenditure needs. Debt restructuring started to make a positive contribution in March/April 2020, having had negligible influence in pre-pandemic years. However, its impact has been decreasing over time. Notably, support for demand from investment loans turned positive again after sharp contractions in 2020 and early 2021. This turnaround signals an improvement in real economic conditions for companies.

Figure 3 Total supply and demand, past and expected developments – net percentages / Note: All indicators in net percentages; with positive values indicating increasing (easing) demand (supply).

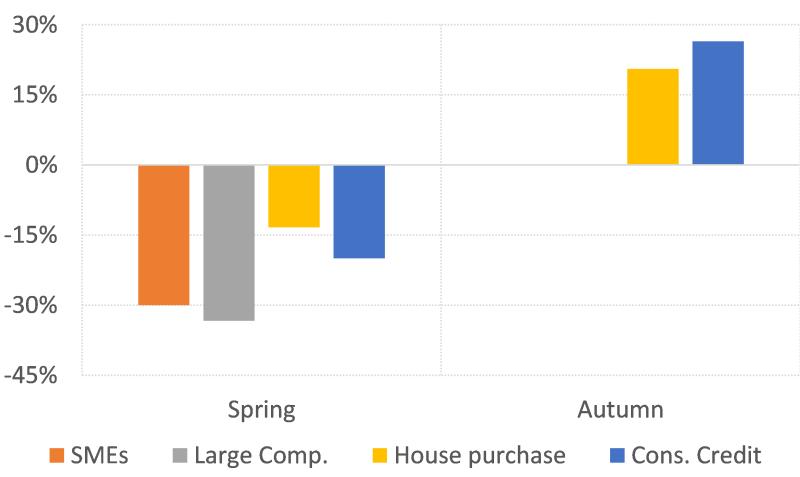

Supply conditions (credit standards) eased somewhat over the past six months, but not yet on companies, including SMEs

Supply conditions (credit standards) eased over the past six months (Figure 3), having tightened in 2020 and early 2021. Supporting this evidence, approval rates have increased in the past six months. This is a very positive development.

However, the aggregate figures hide divergent assessments of single segments of the market (Figure 4). Notably, supply conditions eased substantially in the household segment, but not at all for corporates and SMEs. The terms and conditions of loan supply eased across the board, except on collateral requirements primarily for SMEs.

Figure 4. Supply conditions by market segment

Credit quality started to improve again after mild deterioration in 2020

The COVID-19 crisis reversed the positive trend in asset quality improvements, with nonperforming loan (NPL) ratios ceasing to fall after early 2020. Some small increases in NPLs have been recorded in previous survey waves. More positively, however, NPL ratios improved at the regional level over the past six months (Figure 5), both in the corporate and retail segments. This suggests that policy responses and banks’ strategic adjustments may have played a mitigating role. Conversely, NPL ratios are not expected to improve further over the next six months, thus signalling that elevated uncertainty persists.

Figure 5. Non-performing loan (NPL) ratios

Regulatory and policy measures supporting lending

Banks operating in the region reported that regulatory and policy measures to support lending have played a significant positive role. Notably, banks that took advantage of public guarantee schemes indicate that these have been very effective in supporting loan extensions —a recurrent finding over the last three survey waves. Those banks taking advantage of central bank refinancing operations consider that these facilities have supported credit conditions.

Among the set of regulatory and policy measures, some seem to have been more active than others in supporting lending to the economy. In particular, flexibility on NPL treatment is deemed very supportive. Various forms of capital relief measures, including the release of regulatory buffers, have also contributed significantly, as have the adjustment of risk-weights and avoidance of procyclicality under IFRS 9.

Conclusion

The autumn 2021 release of the survey paints a brightening picture of the banking systems in the CESEE region, albeit remaining pockets of uncertainty and downside risks.

COVID-19 pandemic effects were strong but demand rebounded and supply conditions started slowly to ease. Demand for loans is robust in the household segment and it is coming back also on firms’ fixed investment. Supply conditions are easing, but mostly in the household segment. As a result, scoring demand against supply conditions, SMEs seem to still suffer the most.

Moreover, NPLs decreased over the past six months with no NPLs spike so far, but uncertainty remains elevated. Against this backdrop, banking groups operating in the region show a supportive strategic assessment, with a positive and selective approach in terms of operations backed by increased profitability.

Finally, yet importantly, aggregated deleveraging has been avoided so far on the back of the ample national and international policy response.

Luca Gattini heads the macroeconomic scenarios unit of the European Investment Bank’s Economics Department