Faced with the immediate challenge of the COVID-19 pandemic, the European Investment Bank acted decisively to protect jobs, to back crisis-afflicted industries and to help absorb the most violent of economic shocks. In doing so, we did not lessen our commitment to the long-term battle against the climate threat. We used our experience and expertise to incorporate our climate goals into our pandemic safety net. It is in nobody’s interest simply to rebuild. With the EIB, Europe and the world can build back better.

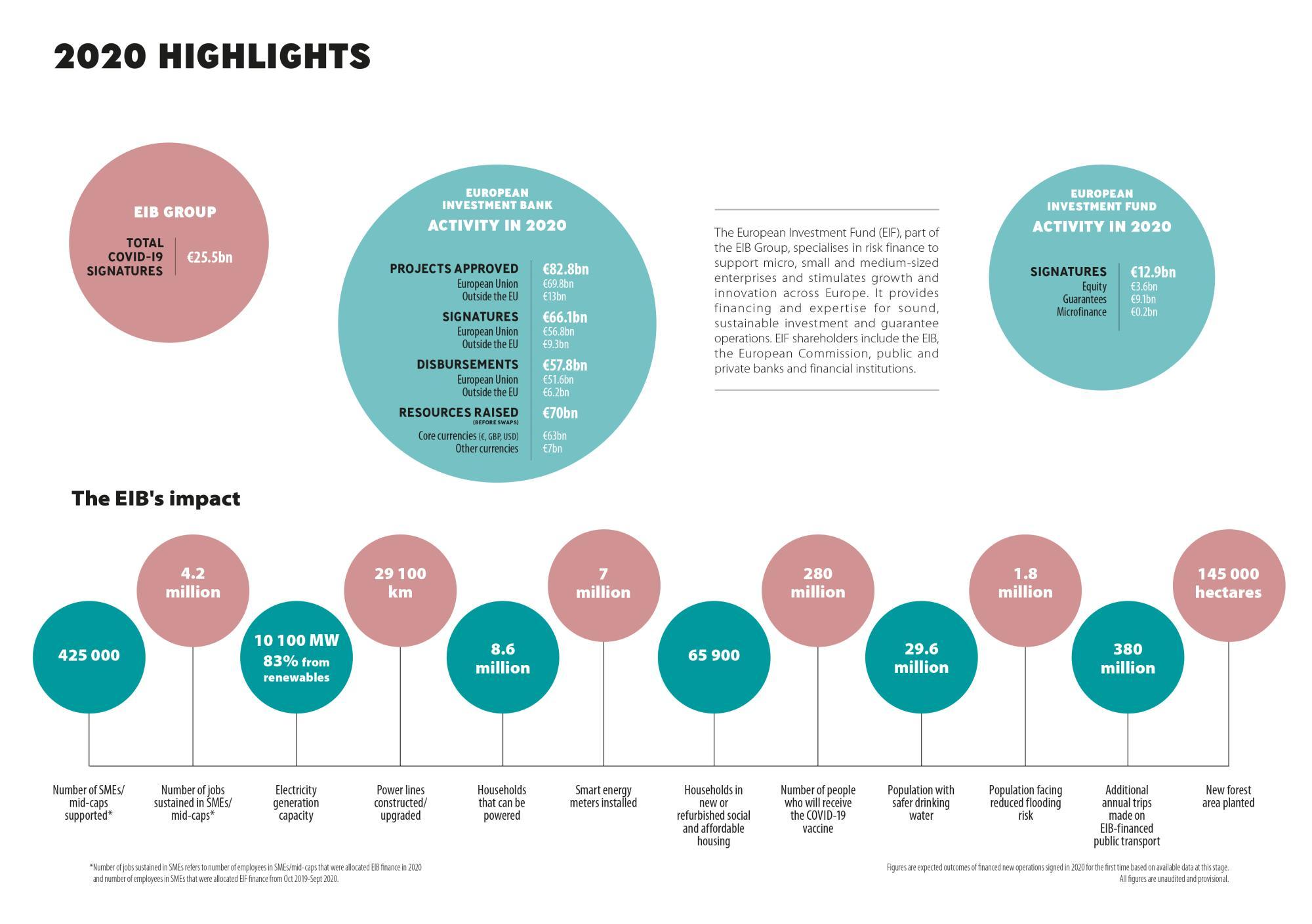

In 2020, we fought COVID-19 itself, with investments in companies researching tests, therapeutics and vaccines. Our financing supported health systems in countries across the European Union and backed the development of key technologies that might, in fact, shorten the pandemic. We confronted the disease’s impact on the economy with a raft of immediate measures to inject liquidity into the economy for small business in particular, even as we prepared the more comprehensive Pan-European Guarantee Fund.

+ Read moreUnlike previous shocks, this crisis originates in the real economy, not the financial or sovereign sectors. Millions of perfectly healthy firms suddenly suffered liquidity problems due to lockdowns. By providing up to €200 billion of investment to the real economy, the Pan-European Guarantee Fund is already helping ensure that healthy firms (and the jobs they provide) are safeguarded – and that their troubles do not migrate to the banking sector and, thence, to public sector balance sheets.

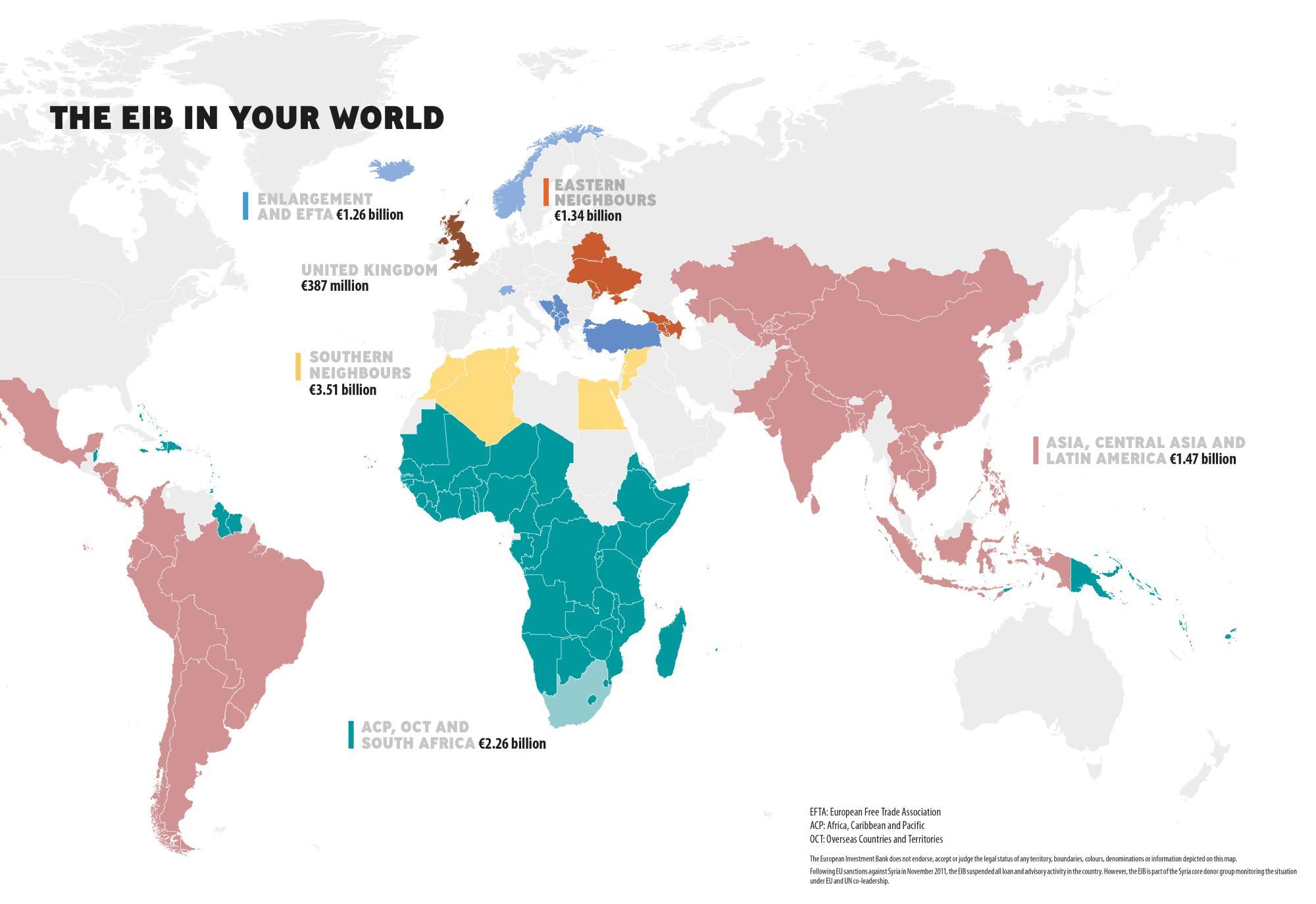

As the world’s biggest long-term multilateral borrower and lender, we did all this whilst paying careful attention to the implications of our investment for the challenges that shall remain after COVID-19. And we did it with a global perspective. Our investment is sustainable and green, battling the pandemic even as we lay the foundations for a crucial decade of struggle against climate change. We partnered with other multilaterals and investors to ensure that a solution for COVID-19 would be shared with developing countries too, approving a €400 million deal with COVAX, a global initiative to promote equal access to a vaccine in developing countries. This was a moral responsibility, and it is also a key contribution to the achievement of the UN Sustainable Development Goals.

In development, too, we must harmonise the desire to create jobs and growth with a serious approach to climate investment. After all, our EU climate action will not stop global warming by itself, because 90% of emissions are generated outside the European Union. If the growing demand for energy in Africa, for example, is addressed through coal- and gas-fired power plants, our climate ambitions will literally go up in smoke.

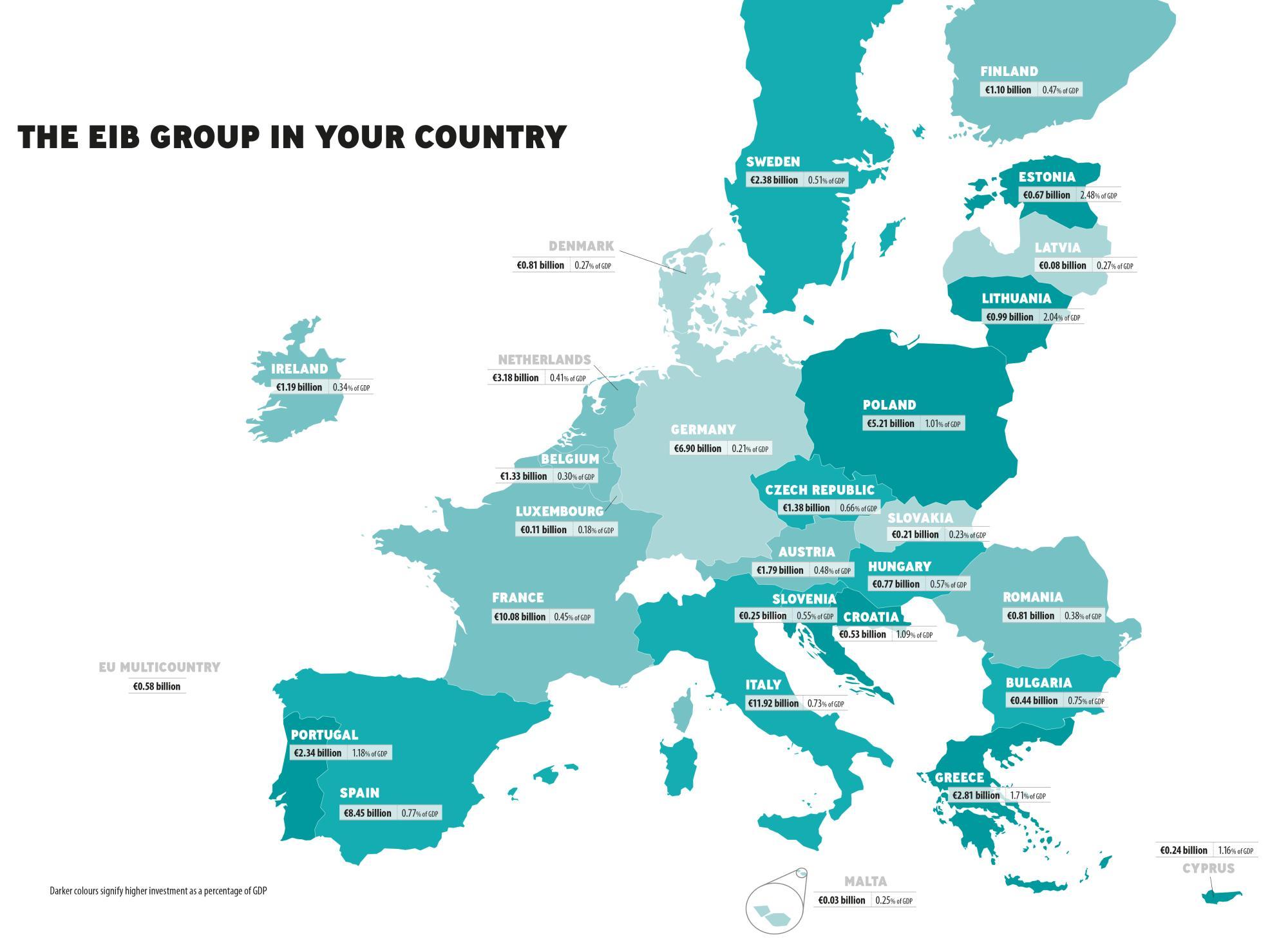

An equitable spread of investment is not just a matter of global north and south. Regional convergence within the European Union has slowed in recent years, in particular between urban and rural areas. We need to make sure that COVID-19 does not accentuate this divide. As with COVID-19 and climate change, our cohesion investments are aimed at immediate economic gain and long-term sustainability. The “just transition”, which bolsters regions moving away from polluting industries, also makes absolute market sense. Look at the record of the European Fund for Strategic Investments (EFSI), the financial pillar of the Investment Plan for Europe, which in 2020 successfully concluded its five-year march to over €500 billion in supported investment. EFSI is fully market-driven, yet the top five recipients of EIB loans backed by the EFSI guarantee, measured against GDP, are Estonia, Greece, Bulgaria, Portugal and Latvia. Four out of ten EFSI operations from the EIB are located in Cohesion areas. When our backing offered an opportunity, Cohesion regions responded with bankable projects. EFSI mobilised investments all over Europe that would otherwise have been too risky. EFSI shows how to support private sector investment with relatively low public spending. This is important for the just transition and is valuable experience to be carried through to the Recovery and Resilience Facility, the European Union’s COVID-19 stimulus programme.

In 2020, our focus on the crucial climate decade ahead did not waver. Our Climate Bank Roadmap, approved by our Board in November, lays out all the intricate parameters of our climate work for 2021-2025. This groundbreaking document highlights our commitment to align all our work with the Paris Agreement. The EIB is now the first multilateral development bank that will spend no money – zero – on anything that has a negative climate impact. The EIB is the EU climate bank, and the largest section of this Activity Report illustrates our work to counter global warming.

Innovation is key to our climate action ambitions. We cannot rely on current business models to achieve the massive cuts in emissions necessary to meet the goals of the Paris Agreement. We need enormous increases in the use of existing renewable energy and energy efficiency technologies, as well as the development of new climate technologies. Yet any economic downturn hurts new technology investment, because it is perceived as risky and non-essential. There could be no worse time for a slump in innovation. Europe and the world needs more than ever what tech brings to the table: disruption of business as usual and accelerated and exponential growth.

At the EIB, we are doing our part to maintain innovation investment. By providing long-term financing and reducing investment risk, we promote a more predictable market environment for new, sustainable technologies. We do not measure our success by the amount of money we lend. We look for impact, for contributions to the structural changes required in Europe’s economy and for advances in the prosperity and safety of ordinary people around the world. The European Investment Bank is proof that Europe delivers.

Werner Hoyer

- Read less